Innovation Sweet Spots: Food innovation, obesity and food environments

Chapter 1: Introduction

This chapter describes the types of food technologies and innovations included in the scope of this project, and provides an overview of the Innovation Sweet Spots approach to analysing the trends and impact of these innovations. We also outline the contents of the following chapters.

Technologies and innovations shaping the future food environment

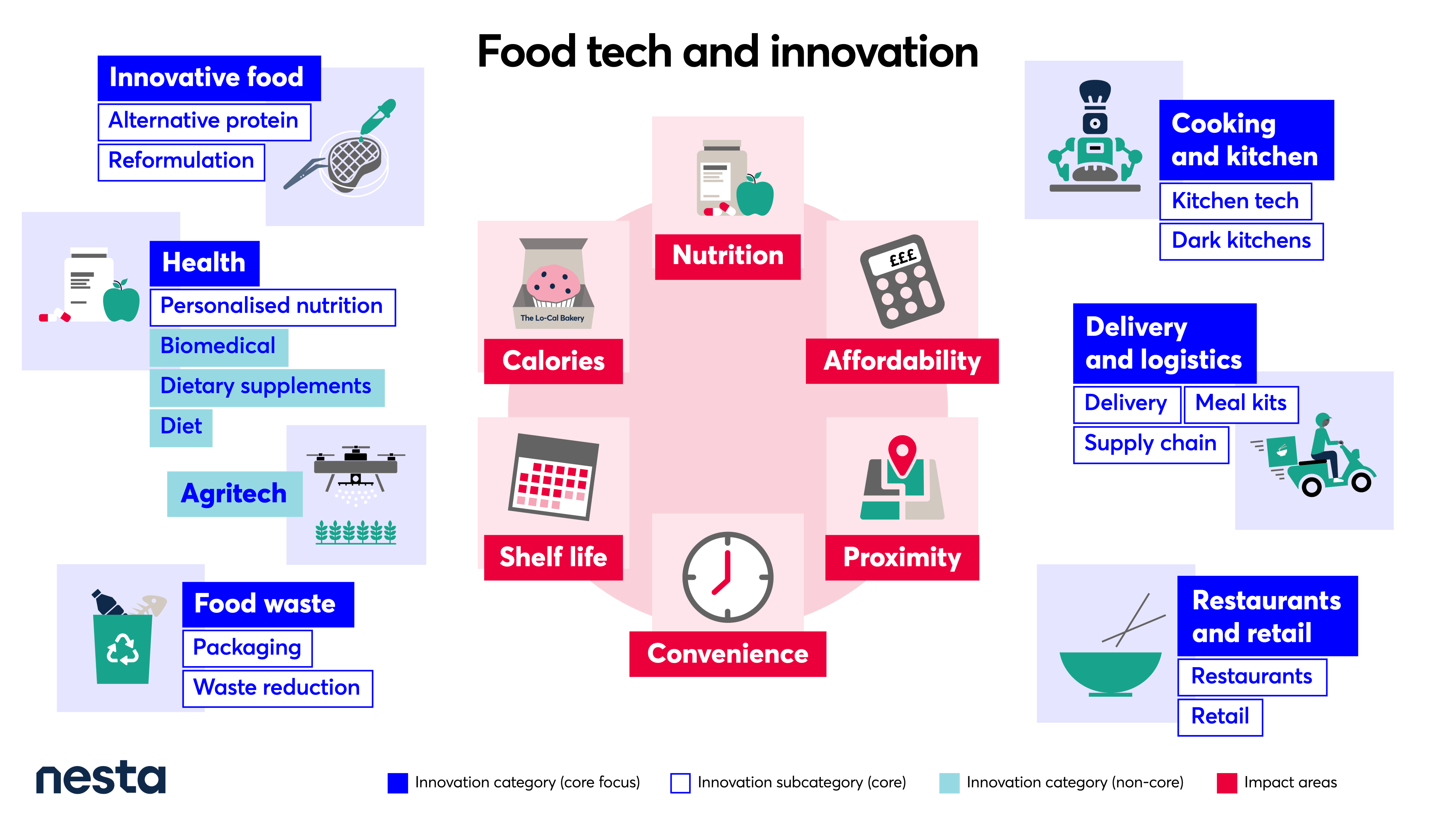

Figure 6 below shows the main areas of food-related innovation that we considered in this project. They cover a wide range, from ingredients and food preparation technologies, to logistics and food waste reduction. We arrived at this typology of innovations through desk research, and validated it through discussions with experts in the food sector.

Our typology helped us organise the various data used in the project, ranging from venture capital and research funding to patents and news articles, into shared categories and subcategories. This, in turn, allowed us to compare signals and trends from different datasets.

Throughout the report, alongside mapping trends, we also considered the potential consequences these innovations might have on health, obesity and food environments, for example by impacting calorie and nutrition consumption, food affordability or physical accessibility of foods.

Main innovation categories and subcategories

Innovative food

The types of food that we eat in coming years could be shaped by a series of significant new processes and technologies.

Alternative (alt) protein is a key subcategory within innovative foods which, as described in further chapters, has seen large amounts of both early stage investment and publicity in recent years. The recent rush to develop alt proteins has been driven by factors such as food security, concerns relating to meat consumption and health, and environmental sustainability issues associated with mass production of meat. These issues have coincided with the development of new enabling technologies and renewed interest and capital from the investor community.

Where possible, we also disaggregate the trends for different types of alternative proteins. Cultured ("lab-grown") meat, animal protein grown from isolated animal cells in factories, has recently seen the first regulatory approval in the US, but it is still long way from price parity with traditional meat. Meanwhile, plant-based burgers and sausages that resemble their meat counterparts such as the celebrity-backed Beyond Meat burger are already widely available. There is also renewed interest in protein production using microorganism fermentation, both the ‘traditional’ form which uses non-genetically altered organisms (for example, Quorn) and the newer process of ‘precision fermentation’, which utilises genetically altered organisms to produce the desired proteins (eg, Perfect Day’s milk protein).

Another important innovation subcategory we have considered closely is the reformulation of foods. Innovations in this category are directed at changing the calorie and nutrient content of food we already eat. This is done by finding ingredients with novel properties we might be able to use to redesign foods that resemble those that we already eat, but which are healthier and/or have less calories. Understanding the barriers and opportunities to reformulate foods to reduce calorie consumption is also a major focus for Nesta’s healthy life mission.

For example, esterified propoxylated glycerol (EPG) reduces calories from fat by 92%, adding fibre to flour can make carb-heavy foods healthier, whilst sweet-tasting proteins are intended to help make treats healthier. Besides specific alternative ingredients, computational and machine learning approaches have the potential to speed up reformulation, as in the case of the start-up Amai Proteins, which uses a combined approach of precision fermentation and computational protein design to create sugar replacements.

Note that we aimed to limit the reformulation subcategory to companies, patents and research projects linked to innovative techniques and ingredients with the potential to improve the nutritional properties of food. Specific novel food brands and products were another prominent area of venture and research funding but these do not necessarily focus on healthier products, and hence we kept these types of innovations to a more general ‘innovative food (other)’ subcategory.

Cooking and kitchen technologies

Another area we investigated is cooking and kitchen innovations, which impact the preparation of meals. Here, we distinguish a kitchen tech innovation subcategory, which includes both industrial and domestic kitchen robotics as well as smart appliances like a “beverage printer”, which makes a wide range of customisable drinks such as iced coffees and cocktails. It also includes software apps for home cooks and professional kitchens that help streamline operations and administrative work. We note that the adoption of robotics in domestic kitchens is probably still a long way off, and will likely be too expensive for most homes. However, robotics and automation solutions could improve the productivity of commercial kitchens, with some companies claiming a fourfold increase in labour productivity.

Alongside this we also consider as a separate subcategory dark or cloud kitchens: food facilities focused on producing delivery-only meals.

Delivery and logistics

In recent years, there has been a shift in how people purchase and access food.

Food and takeaway delivery platforms like Deliveroo expanded extensively during the pandemic, with restaurant delivery companies seeing an 18% growth in users according to a survey by McKinsey. Another more recent (and perhaps more transient) area of growth in 2021 were so-called ‘ultra-fast deliveries’, companies which aim to transport groceries to doorsteps in just 10 to 20 minutes. As grocery deliveries are now said to cover 99% of UK households, and with online food delivery sales continuing to increase in the UK, it will become more and more important to consider how these technologies are shaping consumer behaviours – especially as there are indications that food purchased from restaurants, fast-food outlets and takeaways is usually associated with higher calorie intakes.

A further subcategory we consider are meal kits, including subscription-based offers for ready-made meals or pre-selected ingredients and recipes for home-cooked meals. In theory, meal kits have the potential to free up people’s time and make a positive impact on diets if they are both affordable and healthy.

We also consider various innovations along the supply chain, such as warehouse or picking robots, optimisations to cold-chain technologies required to keep food fresh, or data trusts to increase transparency and efficiency of food supply chains. Innovations like these could improve productivity and reduce costs for food delivery and preparation businesses.

Restaurants and retail

Innovations in this area will impact our physical food environment by influencing how people shop for food and how restaurants are run.

During the pandemic we saw restaurants adopting technologies like QR codes, used for ordering, which are just one example of a wider array of solutions aiming to streamline restaurant operations and processing of payments.

As fast food restaurants are increasingly replacing cashier staff with automated touchscreen kiosks, in the retail sector supermarkets are also developing checkoutless stores. Such technologies, however, might have unintended consequences — for example, there have been observations of customers spending more money and ordering food with slightly more calories when using self-service kiosks.

Food waste

In the UK, we waste about 9.5 million tonnes of food per year, incurring significant economic and environmental costs. The issue of food spoilage is particularly important in light of the rising cost of living, as the limited shelf-life of fresh produce can deter people from purchasing it.

Innovations in this category aim to help with waste reduction and include apps like Olio and Too Good to Go – connecting people or businesses who have surplus food with potential consumers of that food. Other solutions in this category aim to reduce waste by optimising restaurant operations through specialised software and demand forecasting.

In this field we also distinguish a subcategory of innovations in food packaging, given recent interest in ‘intelligent’ packaging technologies that extend best before dates of fresh produce. Examples include novel surface coatings and sachets releasing natural plant hormones which claim to increase the shelf life of fresh produce between 40 to 80%.

Health

There are a growing host of innovations that aim to deliver improvements to people’s diets and weight.

Personalised nutrition services leverage developments in testing technologies and machine learning algorithms to provide diet recommendations tailored to an individual’s specific lifestyle and biology. For example, the ZOE service provides a battery of tests including two weeks of continuous monitoring of blood glucose, blood fat, and the gut microbiome, which then feeds into a personalised nutrition plan for users. In the future, home test kits will likely become more affordable and increasing amounts of nutrition data might lead to more accurate measurements and greater personalisation.

To a more limited extent, we also analysed innovation trends linked to (non-personalised) diets and dietary supplements, as well as biomedical solutions. In the latter subcategory, for example, we have included companies working on weight loss balloons, which are placed in the stomach and help one feel full with less food, or brainstem stimulation therapy to improve glucose and insulin regulation, as well as broader research, news and parliamentary discourse that is directly linked to obesity or overweight.

Analysis of trends in pharmaceutical interventions for facilitating weight loss, however, is out of scope for this report, as their development and path to market generally takes place over a longer period of time (ie, more than a decade). This means our methodology is less suited to capturing trends in this area.

Agritech

Finally, agritech innovations impact agriculture and the production of food. Digital technologies, automation and biotechnologies are making an impact on this sector, with the potential to increase productivity and hence reduce the cost of food.

While this is a growing and an important area of innovation, we chose to limit our analysis only to broad trends in venture capital investment. This was motivated by the fact that these innovations have a more indirect path to impacting consumers compared to the other types of technologies and innovations covered in this report.

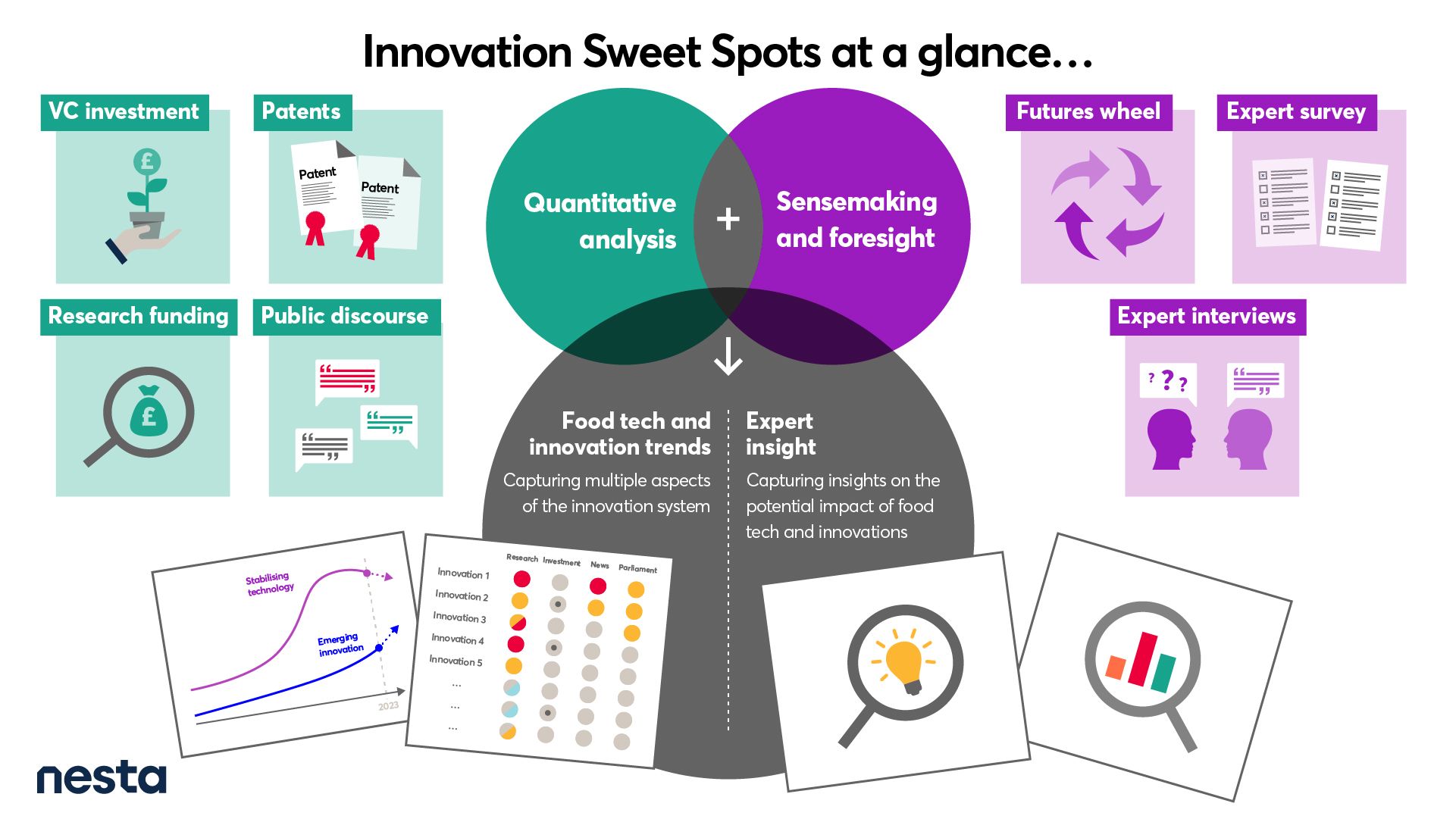

The Innovation Sweet Spots approach

Nesta’s Discovery Hub has developed Innovation Sweet Spots as an experimental, data-led approach to analysing trends in ecosystems so we can better anticipate the social impact of innovations and emerging technologies. We use data science methods to analyse large datasets related to venture capital investment, patents, research activity and public discourse that are commonly only considered in isolation.

By bringing these together we can build a multi-dimensional picture of emerging technologies that capture multiple aspects of the innovation system (see Figure 7 below). Here, we have leveraged this approach to study trends in food technologies and innovations.

To identify 'sweet spots' – where specific technologies or innovations are well-positioned to make a significant impact on health, obesity and food environments – we look for a high level of research and patent activity and strong growth in private investment alongside an escalating degree of interest from policymakers and the public. Taken together, signals of this nature would be indicative of a maturing ecosystem underpinning an innovation. Equally, in cases where trends are clearly misaligned – for example strong growth in research activity not being matched by private investment or policymaker interest – this can be indicative of a need for interventions.

Trends typology

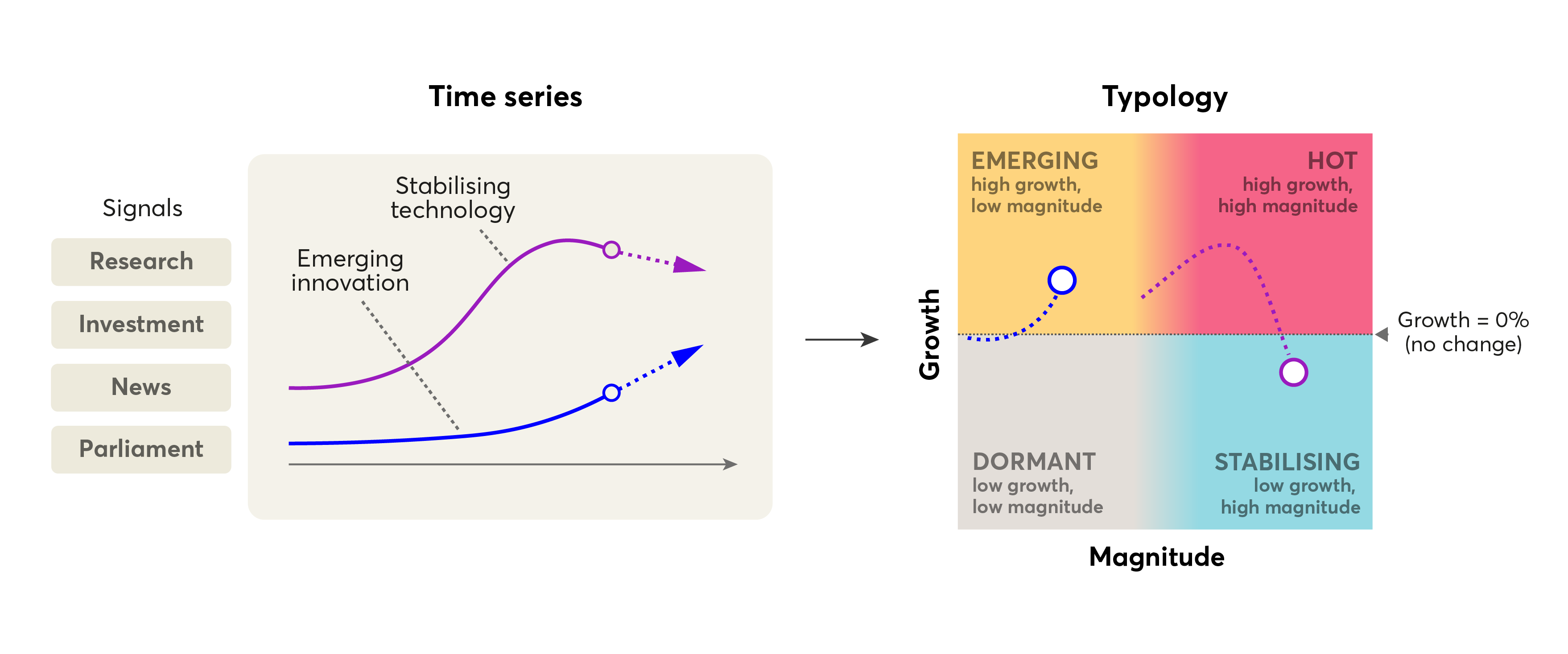

To interpret and communicate findings emerging from the use of the Innovation Sweet Spots methodology, we have prototyped a data-driven typology that categorises innovations as dormant, emerging, hot or stabilising (see Figure 8 below).

Our typology is applied on time series related to a particular technology, and takes into account the growth (ie, an estimate of change across a five-year time period) and magnitude (ie, the average value across the same five-year time period). The time series could be, for example, the yearly number of new research projects or the amount of venture capital investment.

Growth is one of the main attributes when evaluating emerging technologies, as the pace of change is indicative of how rapidly an innovation is emerging and evolving, whereas magnitude provides an indication of the scale of adoption and market penetration. This can help us understand and compare where the innovations and technologies are in their life cycle. For example, an innovation with high growth but small magnitude would be still relatively marginal in terms of scale but rapidly emerging, and hence would be interesting to monitor for future development. A similar type of analysis has been previously proposed, for example, by researchers at the Fraunhofer Institute for Systems and Innovation Research and Technical University of Berlin.

We focused on five-year trends throughout this study, and generally report trends up until the 2021 calendar year (as data for 2022 was incomplete at the time of writing). To smoothen the often quite considerable year-to-year fluctuations of time series, we calculated the magnitude as the average value across the five years between 2017 and 2021. To estimate growth in the same time period, we first calculated a three year rolling mean of the time series and then calculated the percentage increase of the smoothed values from 2017 to 2021. In other words, the growth characterises the relative percentage increase in the average value in 2019-2021 versus the average value in 2015-2017. Unless noted otherwise, we used this approach throughout the report to obtain a smoothened growth estimate capturing the general growth direction of the time series in question. Where relevant, we also discuss significant recent developments that have occurred in 2022.

We categorised innovations with a positive growth percentage as either emerging (positive growth but relatively low magnitude) or hot (positive growth and large magnitude). Conversely, innovations with a negative growth percentage were deemed as stabilising (negative growth but large magnitude) or dormant (negative growth and small magnitude).

We make the distinction between emerging and hot, and between dormant and stabilising, in relative terms by comparing the different innovation categories and drawing the threshold at the median magnitude value. We appreciate, however, that there is no hard objective threshold between these categories and there is also an element of qualitative judgement when using this typology to summarise trends across different levels of granularity (ie, categories and subcategories).

The rationale for this approach – as well as the limitations – is further described in the context of the Innovation Sweet Spots pilot on green technologies. We provide further, specific detail on methodology in each of the chapters.

The structure of this report

The following chapters feature analysis of different specific components of the innovation system and highlight key trends. Each chapter is intended to be as self-contained as possible, allowing the reader to explore the parts of this report most relevant to them.

Chapter 2 describes our analysis of global venture funding signals, shedding light on the innovation occurring primarily in start-ups. As such, the innovations highlighted in this chapter are already being tested in the market and are starting to make an impact on health and food environments.

We continue by analysing patent trends in Chapter 3. We restricted the scope of patent analysis to the area of food reformulation, which was seen by our expert panel as one of the most promising innovations to help reduce obesity (see also Chapter 6). As patents protect intellectual property, they can be seen as an early signal of innovations that might eventually find their way to market.

In Chapter 4, we describe our findings on public research funding trends in the UK. These have the advantage of being an even earlier signal compared to venture funding or patents, as the project abstracts describe research plans for several years ahead and often concern more exploratory or academic work.

Chapter 5 considers the news and parliamentary (House of Commons) discourse around food innovations and technologies. As a proxy for the news discourse, we used the open access platform of the Guardian news website, which, to the best of our knowledge, is the only major UK newspaper to make its text freely available for research. While this data source provides only a partial view of media discourse and can be seen as somewhat politically left-leaning, it can provide signals on whether the innovations are attracting mainstream attention.

To validate our findings and consider the wider impact of these innovations, we also carried out a set of 'sensemaking' exercises involving a broad range of stakeholders including early stage investors, scientists, health practitioners, and policymakers which are described in Chapter 6.

Finally in Chapter 7 we provide detailed policy recommendations based on our findings.